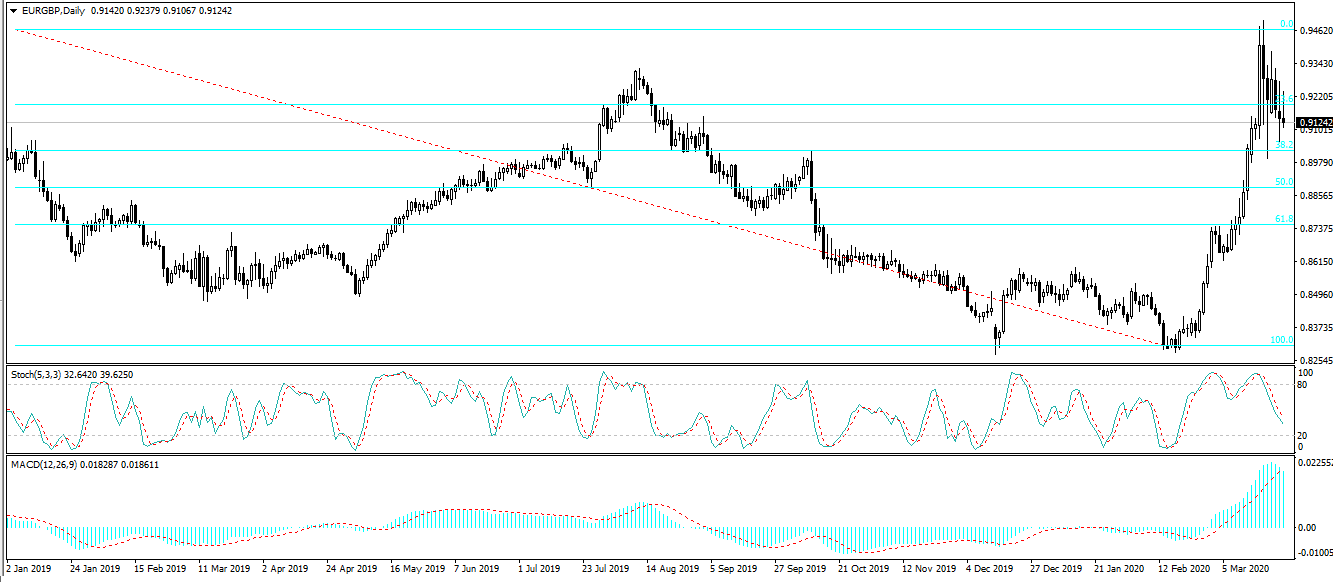

Today our focus will remain on Europe as we take a look at the EUR/GBP currency pair. The pair recently completed a massive bullish wave and is currently undergoing a downward price correction, while remaining at multi-month highs.

The British pound is suffering due to the pessimistic economic forecasts about the United Kingdom. The UK was already likely heading into difficult times due to Brexit at the start of 2020, before the coronavirus became a concern. Now the kingdom’s economy is in even more danger, as the government finally took strict measures to ensure social distancing by sending people home and cancelling all public events and gatherings. The modest recovery in the price we are currently seeing is not so much because the pound decided to strengthen, as much as due to the euro dealing with similar pressures and the pair running out of steam.

Indeed, the European single currency is also dealing with the Covid-19 outbreak and its detrimental impact on the economy. Heavy losses in economic growth are expected due to the closure of so many businesses during the quarantine period; a rise in unemployment is also possible, as the employers whose businesses are closed might not be able to afford paying their employees at the moment and prefer to let them go. In other words, the pound and the euro are both under immense pressure right now and this pair will remain volatile for the foreseeable future.

In terms of the daily chart, today we have a pivot point for the pair located at 0.9163, with the pair currently trading slightly above it. The daily support levels lie at 0.9049 and 0.8939. The daily resistances are at 0.9272 and 0.9387. The indicators of technical analysis agree on a strong buy signal.