Today our focus will remain on Europe as we take a look at the EUR/GBP currency pair. Since last week, the trend has turned bearish, and this movement seems to continue.

The British pound came under pressure recently due to a poorer than expected performance in the economy of the United Kingdom, especially where retail sales and gross domestic product growth are concerned. Then, the pound experienced a short period of weak growth, one that we have seen over the past few days, largely caused by higher risk appetite among investors, which led to more interest in the pound than usual. However, the disappointing economic data and the upcoming pressure of the post-Brexit trade negotiations have given us reason to expect an interest rate cut by the Bank of England in order to support the economy. That decision won’t come until next Thursday, but it is already weakening the pound.

Meanwhile, things continue for the euro in the same vein as the past few months. Recent fundamental reports concerning the eurozone have not been bad, but they haven’t been particularly strong either, indicating that the European Union’s continued struggle with economic growth will continue. Today there is an ECB policy meeting, but a rate cut is not expected at this time. Though the euro lacks incentives for growth, it might appear stronger than the pound at the moment.

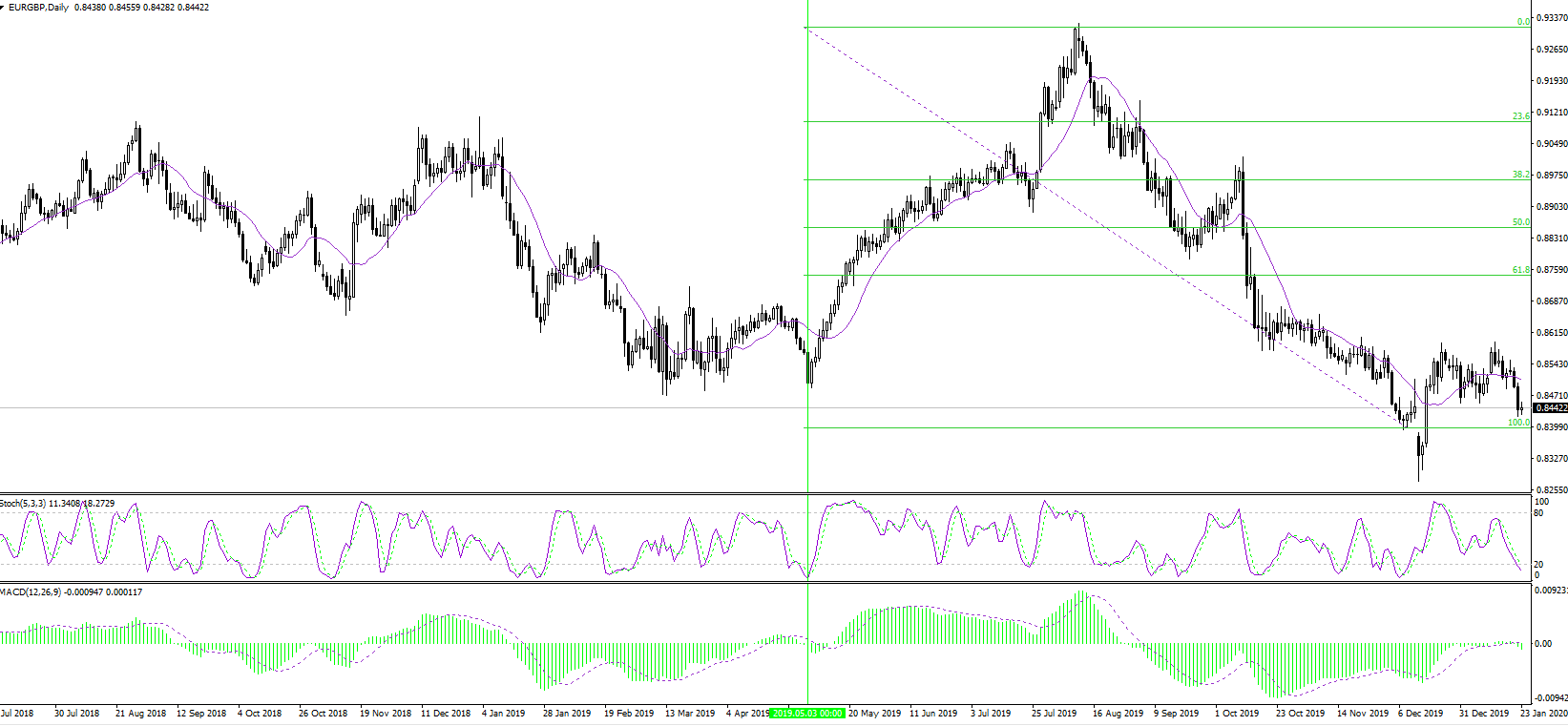

In terms of the daily chart, today we have a pivot point for the pair located at 0.8456, with the pair currently trading below it. The daily support levels lie at 0.8411 and 0.8379. The daily resistances are at 0.8488 and 0.8533. The indicators of technical analysis are confident in recommending a strong sell position today.