Today we shall take a look at the EUR/USD currency pair. February has definitely proven itself to be a month for losses for the euro, with the exchange rate of this pair continuously declining.

The European single currency is no position to strengthen against the dollar at the moment. Last week brought us mixed results regarding Germany’s GDP growth, paired with an unexpected drop in the GDP of the entire eurozone, despite steady employment. This indicates that the trade wars, Brexit, and other uncertainties are exerting too much pressure on the euro right now. Tomorrow the euro might get a chance to stabilize if the ZEW surveys prove positive, but the likelihood of that happening is not very high right now. Thus, we expect the euro to remain weak.

The American dollar still reigns supreme over all other currencies, backed by strong economic data from the United States. Based on the excellent condition of the economy right now, the Federal Reserve decided to cut its stimulus purchases to curb liquidity. This move will tighten the market, which is helping the dollar appreciate in price. Moreover, the continued uncertainty of the coronavirus outbreak in China is increasing investors’ interest in safe haven assets such as the US dollar.

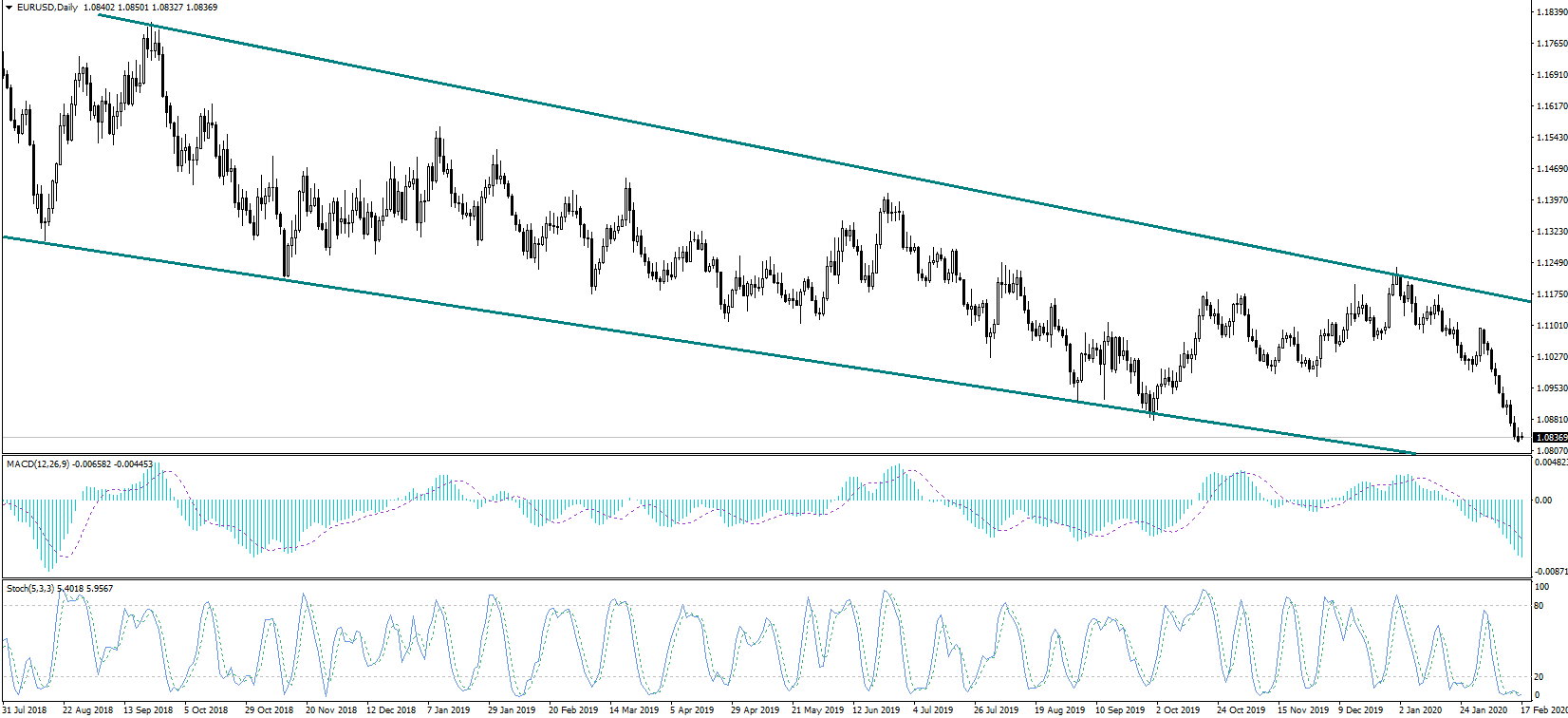

In terms of the daily chart, today we have a pivot point for the pair located at 1.0840, with the price currently trading just a pip below it. The daily support levels lie at 1.0835 and 1.0829. The daily resistances are located at 1.0846 and 1.0851. The indicators of technical analysis strongly and unanimously recommend a sell position today.