Today our focus will remain on Europe as we take a look at the EUR/GBP currency pair. Though the pair spent most of February in decline, over the past three to four days we have seen a slight recovery.

The value of the British pound sterling is currently determined by the overall economic performance of the United Kingdom. Yesterday’s CPI came in at 1.8% versus an expected 1.6%, while the core CPI was at 1.6% instead of the forecasted 1.5%. This improved inflation outlook gave the pound a small boost. However, investors see this as a short-term improvement that will likely not be repeated next month. The overall sentiment for the British pound is not too bright due to the aggressive stance of Prime Minister Boris Johnson regarding negotiations with the European Union, which will dictate the value of the pound throughout 2020.

Meanwhile, the euro has been having a difficult time, more so than usual. Despite a small improvement in German GDP growth, the overall eurozone GDP dropped to 0.9% in Q4 of 2019. The ZEW economic surveys all showed relatively low numbers, indicating investors don’t have too much confidence in the eurozone’s economy right now. Today we expect the publication of the minutes from the ECB’s January policy meeting. The main event for the euro this week will take place tomorrow - namely, the release of the January consumer price index. If the CPI is less than 1.4%, expect a further weakening of the euro.

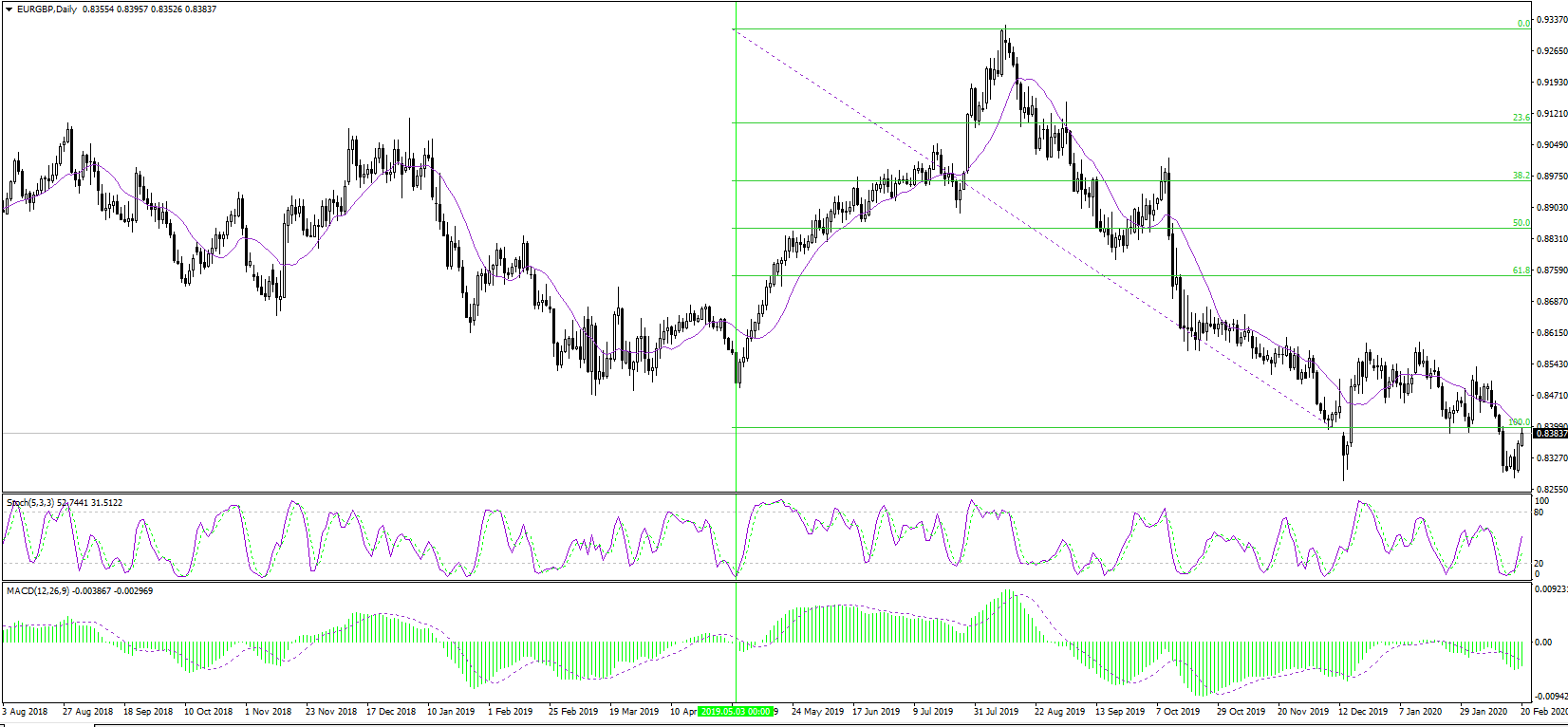

In terms of the daily chart, today we have a pivot point for the pair located at 0.8342, with the pair currently trading above it. The daily support levels lie at 0.8316 and 0.8269. The daily resistances are at 0.8389 and 0.8415. The indicators of technical analysis agree on a strong sell signal.