Today our focus will remain on Europe as we take a look at the EUR/GBP currency pair. Despite a few hiccups, since the middle of February the overall trend for this pair has been bullish.

The British pound right now is losing the battle with the euro, which is interesting, considering both currencies are pressured by the same factors. UK Prime Minister Boris Johnson’s hardline stance on the Brexit negotiations is quite threatening to the pound’s stability, but it won’t help the euro either. However, at the moment the coronavirus is a bigger crisis than Brexit, and remains the main reason for investors to be cautious. The Bank of England already announced a rate cut of .5% to lessen the damage the pandemic is causing to the global economy. The cut came just in time, as yesterday most fundamental reports from the UK failed to meet the forecasts.

The euro is in a similar situation, since the global spread of Covid-19 is affecting the entire world, forcing countries to revise down their economic growth expectations. Today the European Central Bank is supposed to come forward with a decision on interest, deposit, and marginal lending rates. However, analysts do not expect a change just yet, considering that the ECB’s monetary policy is already softer than other central banks’. If there is a surprise cut, this would certainly weaken the euro.

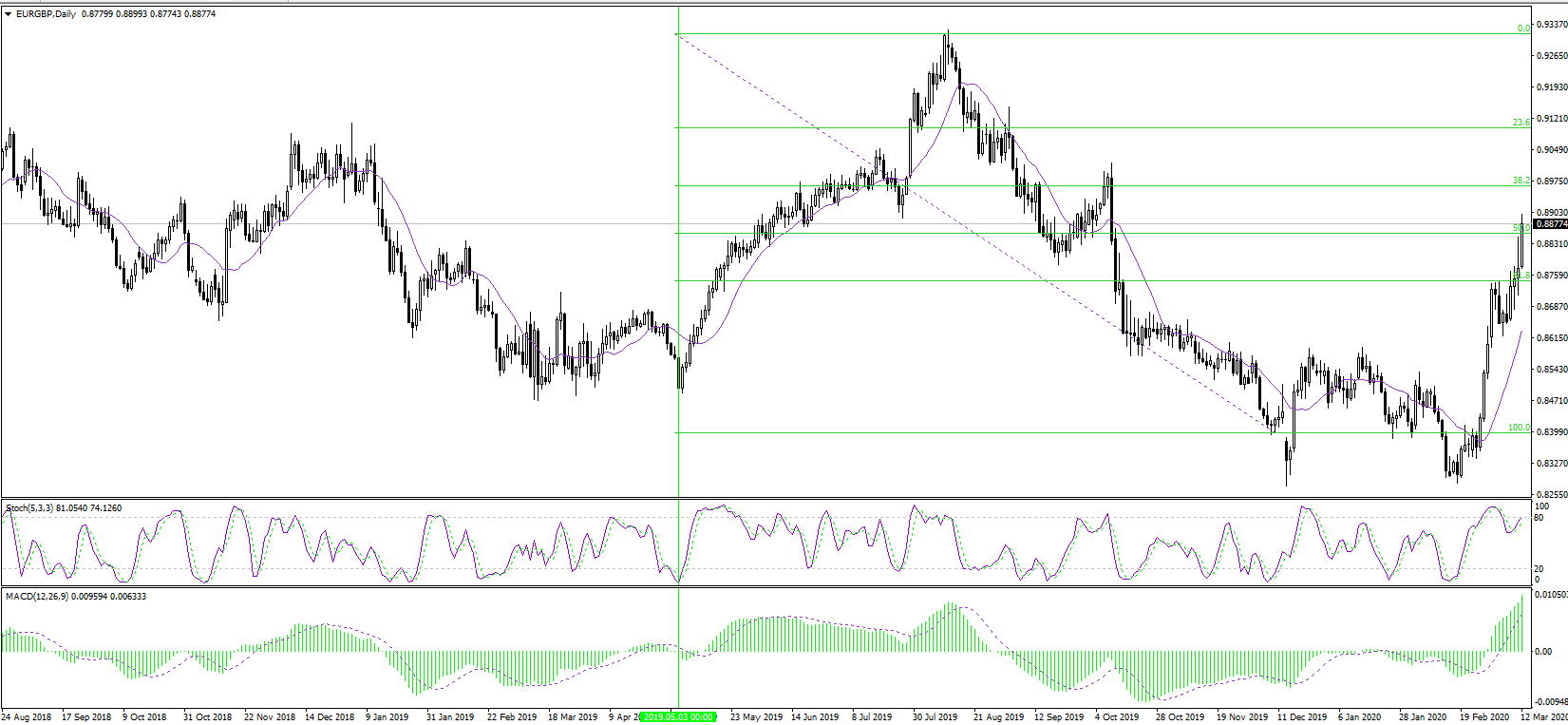

In terms of the daily chart, today we have a pivot point for the pair located at 0.8781, with the pair currently trading above it. The daily support levels lie at 0.8721 and 0.8655. The daily resistances are at 0.8847 and 0.8907. The indicators of technical analysis agree on a strong buy signal.