Today our focus will remain on Europe as we take a look at the EUR/GBP currency pair. The pair has had a shaky journey marked by lots of ups and downs lately. Even this week, there hasn’t been one convincing trend, as the direction of the rate keeps changing.

The British pound is currently in a position where its value changes frequently based on fundamental reports and politics. On the one hand, Prime Minister Boris Johnson’s hard line rhetoric when it comes to the Brexit transition negotiations is weakening the pound, as it shows that a trade deal might be more difficult to achieve than previously expected. However, positive housing data and a better-than-expected construction PMI have offered a short-term boost to the pound. Nevertheless, a rate cut by the Bank of England is still possible, especially in light of Boris Johnson’s unpredictability as a Prime Minister, which contributes to Brexit uncertainty.

The European single currency is also in a tough spot right now. Recent economic reports revealed a lower GDP for the fourth quarter of 2019, lower CPI data, and worse than expected retail sales. Together, these reports paint a grim picture of the eurozone, showing that the economy is very much intent on shrinking rather than growing right now. Because of this, the euro lacks any incentives to strengthen and relies on the other currency in each pair to determine the trend.

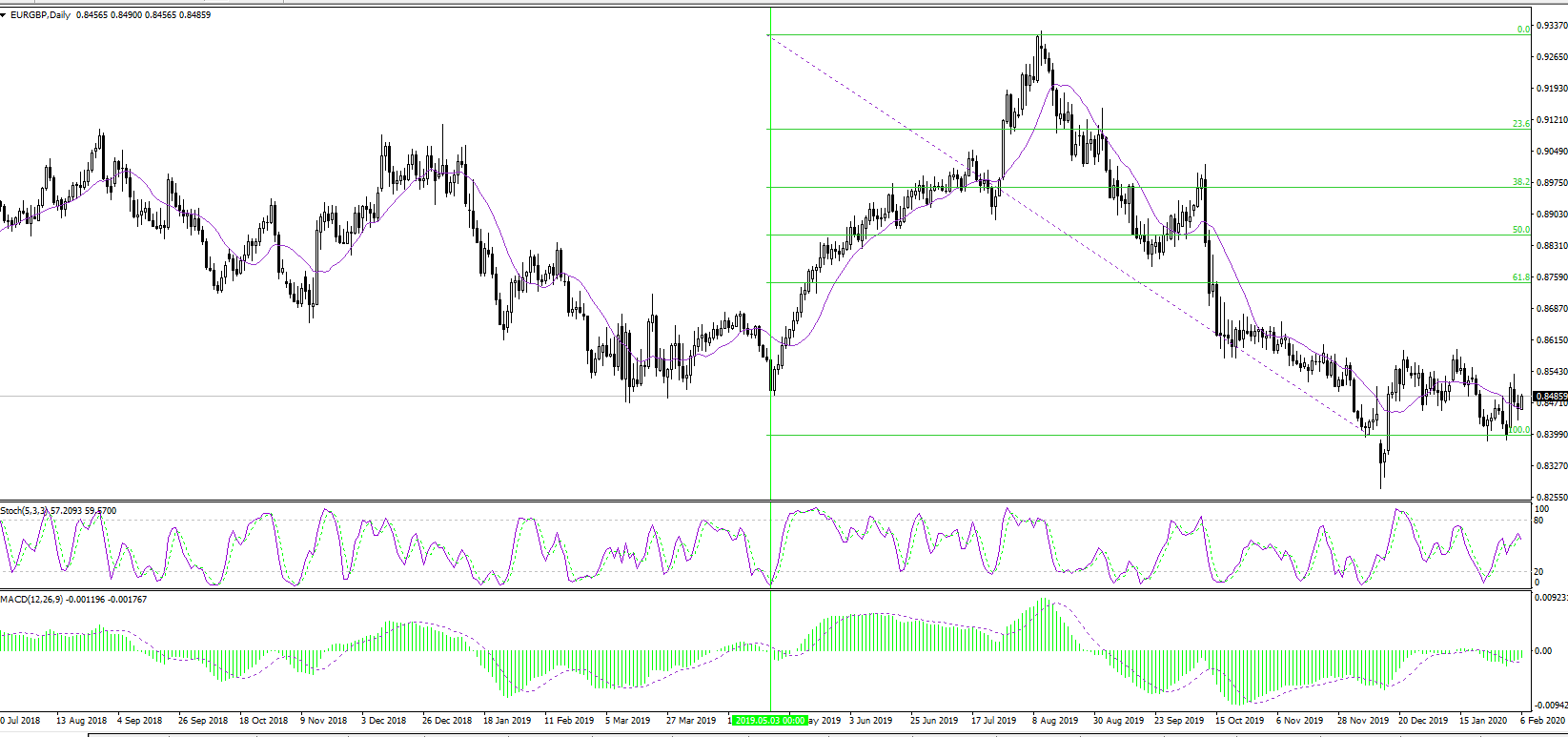

In terms of the daily chart, today we have a pivot point for the pair located at 0.8463, with the pair currently trading above it. The daily support levels lie at 0.8434 and 0.8405. The daily resistances are at 0.8492 and 0.8521. The indicators of technical analysis are a little mixed right now, so we need to wait for a stronger signal.