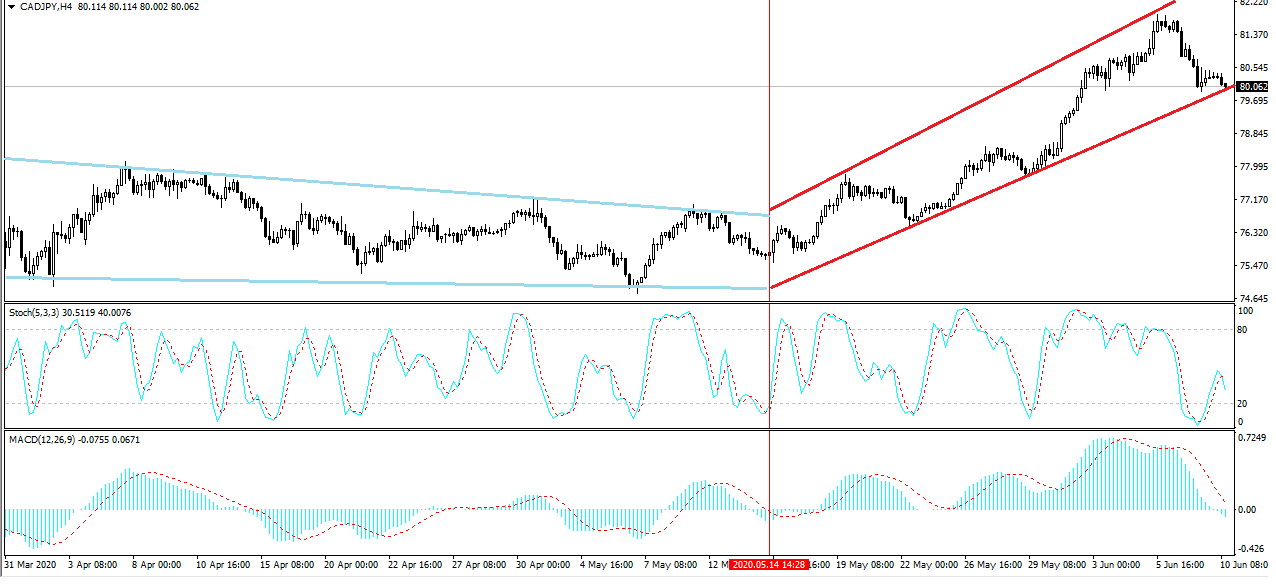

The rates continue within the frames of an uptrend that has been going on for a month. The rapid growth was driven by the recovery in oil prices and investors' optimism about the recovery of the global economy as a result of the easing of quarantines in key countries. However, for the third day in a row we can see the yen strengthening. The increase in demand for safe assets this week was due to the worsening of relations between North and South Korea. In addition, the macroeconomic reports from China published this week were disappointing, which affected commodity currencies.

The rates continue under the influence of external factors, in the absence of key macroeconomic reports on the economy of Canada and Japan. In particular, today the US Federal Reserve is expected to meet, the results of which may affect the mood of investors and their willingness to take risks. So far, the Fed have been taking a wait-and-see position, despite the positive data on the US employment market, though this economic indicator was the most vulnerable due to the pandemic.

At the moment, most technical analysis tools indicate the efficiency of the deals to SELL. However, we believe that the factors in favor of the yen will not be enough for a long decline, and the price correction will be completed soon. Therefore, the deals to BUY should be more effective.